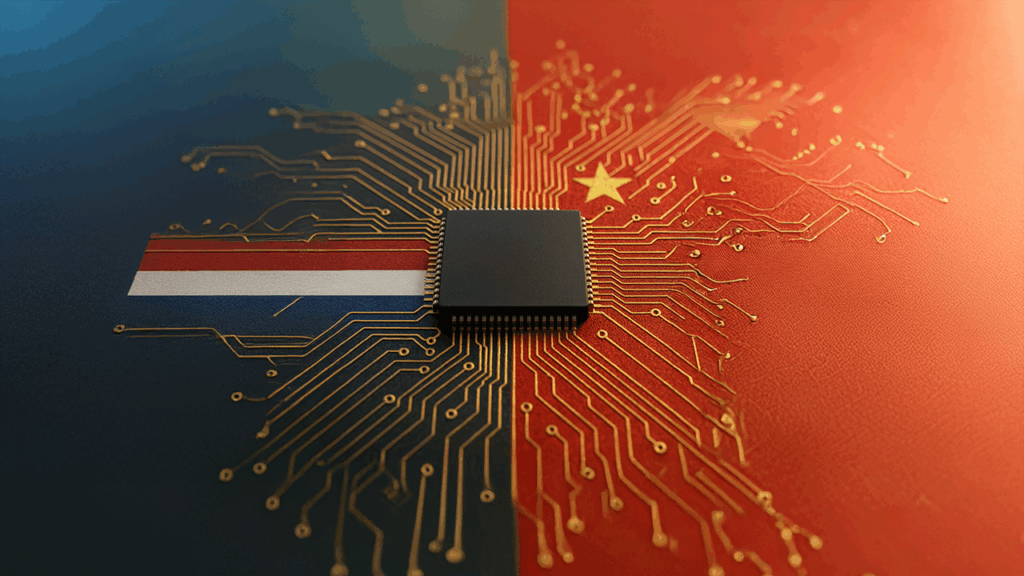

A clear message came out of The Hague today. The government is ready to lift its special oversight of Nexperia once real chip shipments from China to Europe are back on the road. Not later. Not based on promises. Only when pallets and crates are actually moving and that can be verified. That shifts attention away from political debate toward what factories truly need. Parts that arrive on time so the line keeps running. It sounds simple and that simplicity is the point. Companies do not want new statements. They want deliveries they can use in production right away.

What that special oversight is and why it was used

For a time the government could look in and have a say on big decisions at Nexperia. The goal was clear. Protect essential knowledge and production for Europe while daily operations kept going. Machines stayed on. People kept working. But for strategic moves the company first needed a green light from the state. This was not a full stop. It was a brake on large choices. Many operators and investors found that balance tricky. On one side there was certainty about public interests. On the other side there was less room in the boardroom. Today’s signal makes the balance very concrete. Once chip supply is steady again the extra oversight can go and the company gets more control back.

Why shipments from China are the key

The whole chain feels it the moment fewer parts arrive. Automakers push back deliveries of new models. Consumer electronics makers switch to costly alternatives or produce less for a while. Planners on the factory floor shuffle rosters and projects. That absorbs time, money and confidence. By tying the decision to visible shipments you avoid new fights over words. There is only a yes or a no. If chips are on the way and they arrive, the oversight can be phased out. If not, the safety net remains. That clarity helps buyers, logistics teams and suppliers return to normal agreements with carriers and with customers further down the chain.

Will the chip flow really return and what changes on the ground

The answer depends on the rhythm of the trucks and the logs at the border. As soon as the first batches are back in and that shows up in customs and company systems, the state can stand down. For a plant this feels almost like a release. Inventory can be rebuilt. Production schedules can scale up. Teams do not have to invent last minute fixes as often. Suppliers feel safer reserving larger volumes because there is a path to steady demand. It does not hinge on a long list of terms. It hinges on transactions that actually happen. At that point planners can map the next few months instead of just the next week. That gives calm on the shop floor and with the people who own delivery times to customers.

What this means for European industry and for investors

The immediate win is less stress in the supply chain. Less scarcity means less downtime, fewer rush orders and fewer costly detours. That helps margins for makers of cars and electronics. It also helps the firms that deliver the boxes, chips and boards. On time delivery is often the line between a strong quarter and a soft one. For investors this feeds into expectations because predictability has value. The effect reaches beyond Europe. Big American technology firms touch the chain through hardware, accessories and partners. When basic components are easier to get there is less noise around product cycles and partner updates. You may not see it in every revenue line today. You do remove tension for the companies that supply the building blocks and that change ripples through the network.

How this fits the bigger story of policy and technology

The last few weeks showed how fast a policy move can hit factory floors. A national measure in one place and an export limit in another and whole sectors feel pressure. The plan now on the table chooses a measurable path. First deliveries, then less oversight. This is not a complex compromise. It is a practical order of steps. The state protects public interests when needed. The company regains room once supply is moving again. That keeps the threshold low for a workable outcome. Everyone can verify it. If containers clear customs and chips sit on warehouse shelves the condition is met. No endless interpretations. Just a fact.

What companies and investors can do now without getting stuck in doubt

Companies across the chain can prepare for a gradual return to normal ordering patterns. Think about resetting safety stock, rescheduling maintenance and simplifying contracts with core vendors. Investors can watch for signs of normalization in company updates. Not grand statements. Small tells like steadier lead times, fewer rush shipments and a smoother production tempo. These point to less friction in the chain. When friction fades, numbers are often easier to forecast and that builds confidence for the periods ahead. The main thing is to keep focus on the movement of parts rather than the headlines alone.

Conclusion

The Netherlands ties the end of special oversight to a real and visible restart of chip deliveries. That is sober, verifiable and exactly what the market needs. Factories can move when parts come in. Suppliers can plan volumes. Buyers can return to regular schedules. For investors it is a story of less noise and more predictability. In the coming period the focus is not on new statements. It is on pallets rolling into a warehouse and back out to the line. When that happens a chunk of the recent uncertainty lifts and a calmer production rhythm becomes possible.

Want to understand moves like this faster and see which sectors can benefit from a quieter supply chain. Check our economic calendar, broker comparer and asset index on Bitease.