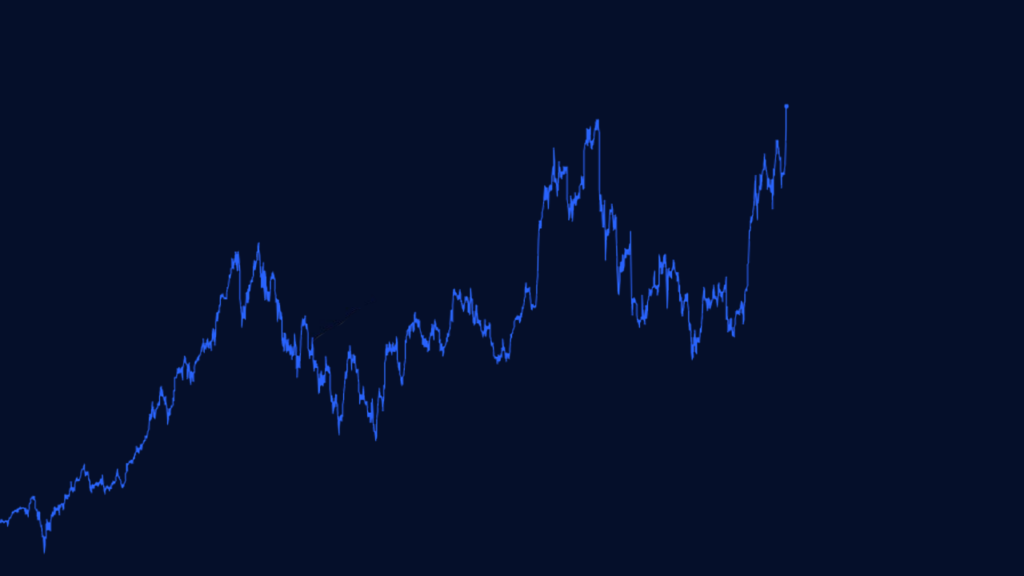

ASML reached a new milestone in Amsterdam today. The stock set an all time high and ended the day at a record close. It looks like a number on the board, but it says a lot about the role of chips and artificial intelligence in this year’s economy. A record does not appear in a vacuum. It reflects real investment, visible production goals and a supply chain that wants to move forward.

What actually happened

The session was shaped by renewed interest in technology. Investors focused on companies that make computing power possible, and ASML sat at the center of that attention. The market looked beyond the moment and toward the demand that is building behind the scenes. Chip designs keep getting more complex and the need for production tools grows with them. In that setting the stock reached a new peak and closed at a record level. Those two markers together show that demand and confidence are meeting.

Why this matters

AI is no longer a promise. It is a tool used every day at work and at home. Those uses need chips that run faster and use less energy. Such chips are made with machines that pattern wafers at an extremely small scale. ASML provides technology that is essential for the most advanced steps in production. When large customers scale up plans, the chain needs extra capacity and service. A record day is not an isolated moment. It is a sign that projects are moving and that budgets to support them are in place.

How this fits 2026

This year is about delivering reliable computing power. That applies to data centers that roll out new AI services and to device makers that want to add smart features. Companies set aside resources, public programs take shape and partners in the chain align their schedules. The pace is high but the dependencies are real. Permits, supply and staffing determine whether ambitious roadmaps stay on track. A record at a key supplier shows that the market expects progress on those roadmaps.

The European angle

The milestone also carries a symbolic layer. A heavyweight on Euronext that sets a record raises the visibility of European technology. That attracts talent, encourages investment and builds confidence across partners in the value chain. Europe wants to rely less on distant production and to build more capacity at home. A strong player in production tools gives that aim a clear anchor point. This is not only a Dutch story. It is a European story about focus, collaboration and long range choices.

What investors can take away

A record is not advice. It is a reminder of where value is created. Behind every app and every service there is an infrastructure of hardware, software and service. Understanding that chain explains why production tools matter so much. The market does not only price expectations. It also reacts to visible steps such as new fab projects, expansions at existing sites and long agreements with customers. The message today is that these links are lining up more often and that demand for tools to make advanced chips is broad.

Quick questions in plain language

An all time high is the highest level ever reached during a session. A record close is the highest closing level ever recorded. These are two different moments on the same day. One shows how high the price got during trading. The other shows where the day actually ended. Together they give a clear picture of interest and confidence.

A second question is whether a record says anything about the next day. It does not. Tomorrow depends on news, results and broader sentiment. What this record does show is that demand for the products and services behind the stock is strong right now, and that the market recognizes it.

The chain behind the screen

Step back and you see a chain that runs on long lead times. From a chip design to the delivery of production tools and the ramp of output, months and sometimes years pass. Planning, test procedures and service matter as much as raw capacity. When a key player sets a record it signals that many links are moving in the right direction at once. It points to confidence in the roadmap and to concrete projects that are making progress.

Looking ahead without a crystal ball

The rest of the year is about execution. Fabs need to go live on time. Partners need to deliver on time. Teams need to place and validate new systems. Policy changes and trade arrangements need to be clear enough to offer predictability. That is where real value lives. Today’s record is a snapshot that suggests the market expects this puzzle to keep coming together. It is not a prediction for the next print. It is a clear sign that the underlying demand remains broad.

Conclusion

ASML reached an all time high in Amsterdam and finished at a record close. The moment is more than a number. It shows that computing power sits at the core of the 2026 economy and that the chain that enables it is in full motion. That makes this news relevant for anyone who wants to understand where the next waves of growth may form and which players flip the switches.

Want clear context on moments like this and direct access to the data that matters? Open our economic calendar and explore the tools in the Bitease asset index.