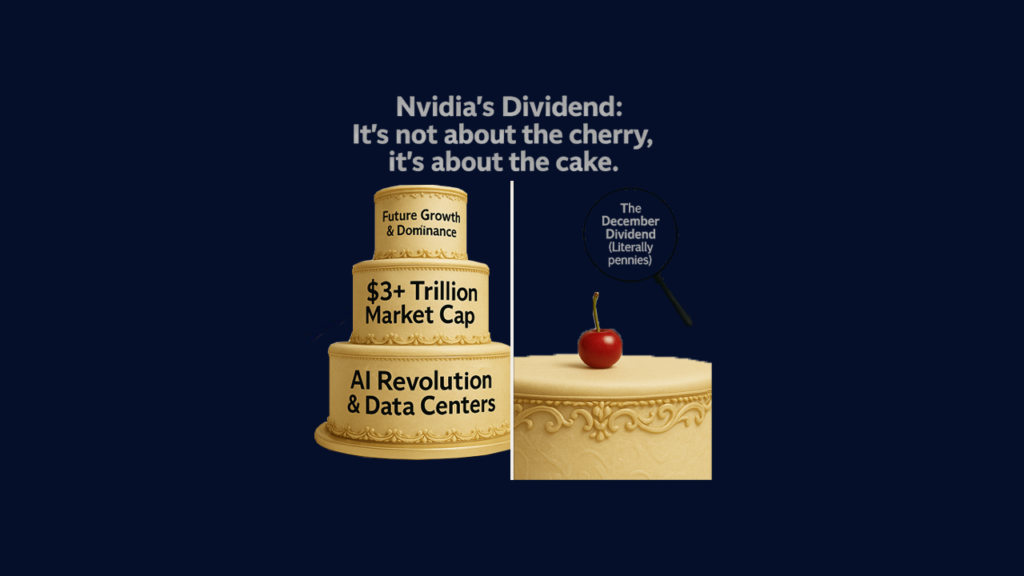

Nvidia is stepping into the spotlight this week with a moment that looks small on paper but says a lot in practice. The ex dividend date falls on December 4 and the payment follows on December 26. The distribution is one cent per share. That sounds modest, yet inside Nvidia’s record year this detail carries a clear signal. In this article you will read what the timing means, how it fits the company’s broader capital policy, and why December becomes easier to navigate for investors

Why this dividend matters right now

With this payout Nvidia underscores discipline and continuity. Demand for AI infrastructure is surging and investments in data centers and software remain a priority. The company keeps the dividend small while actively returning capital through share repurchases. In the first nine months of the current fiscal year thirty seven billion dollars already flowed back to shareholders. That shows the capital policy does not stand apart from the growth strategy. It supports it. The engine keeps running at high speed while the base is strong enough to reward shareholders in a steady way.

The timing of December 4 and December 26

The ex dividend date on December 4 determines who is entitled to the payment on December 26. Anyone who buys on or after the ex date does not receive this distribution. Choosing a date in the second half of the month and a payment right after Christmas adds clarity to a period when liquidity often thins and portfolios are being wrapped up. For investors this creates a simple rhythm into year end where rebalancing and fiscal planning meet actual cash flows. Nvidia communicates these dates with precision so investors can align their calendars exactly.

A one cent payout with real context

The one cent per share is not designed as an income stream. It is the visible link in a larger approach where buybacks take the lead and investment continues. Since the dividend increase in 2024 and the subsequent stock split the payout has stayed at this level while operating results accelerated. The message is straightforward and credible. Growth first. Reward at the same time. Never at the expense of firepower.

What this means for your December planning

The weeks around the ex date often draw extra attention because positions get adjusted to registration dates and cash flows. For active investors it functions as an organizational anchor. It helps you sync news flow, reweighting, and the calendar of your own trades. The December 26 payment lands when many participants close the book for the year. Predictability is valuable in that phase because it keeps short term noise from distracting you from the longer arc of fundamentals. Nvidia’s clear guidance makes it easy to fit this into a personal plan.

Capital policy as a signal inside the MAG7

Among the largest names in the US market capital allocation is a marker of maturity. Nvidia can return billions while keeping an aggressive investment program intact. That is a signal that reaches beyond the stock itself. It shows that leaders in the AI economy are balancing expansion of dominance with steady reassurance for shareholders. This December payout is less a financial windfall and more a confirmation that the house is in order. The mix of precise dates, stable distributions, and meaningful buybacks resonates with both professionals and retail investors.

Conclusion

Nvidia’s December dividend is small in dollars and big in meaning. The ex date on December 4 and the payment on December 26 anchor the end of the year and show that discipline and growth can move together. Inside a record year this distribution works as a compact signal that strategic investment remains the priority while shareholders still get consistent treatment. For anyone who wants to structure the final weeks of the year with intent this is a practical touchpoint that brings planning and action closer together.

Want to turn calendar moments like this into decisions with less friction. Visit Bitease today and explore the economic calendar, the asset index, and the new stock scanner.