TSMC’s latest figures point the way. The Taiwanese giant reported solid revenue growth and that sends a clear signal across the industry. When chipmakers step on the accelerator, fabs expand and attention shifts to the makers of the most advanced machines. That is where ASML stands in the spotlight. Today ASML traded clearly higher with a gain around four percent, while earlier this week the stock was up more than five percent after an upgrade. Combined with renewed tech optimism, the market started to price in what comes next. This turn confirms the ASML investment cycle.

What TSMC’s sprint says about the next investment round

TSMC’s fourth quarter revenue came in ahead of expectations. Behind that sits persistent demand for compute. AI chips and advanced nodes pull capacity toward its limits. That makes more cleanrooms, more advanced packaging lines and a faster move to newer processes a logical step. The timing matters because TSMC traditionally outlines capital plans in mid January. Today’s hard revenue data gives those plans more credibility. For investors, the cycle of shifting capex budgets is tilting back toward growth.

Under the hood it is not only about narrower transistors. The back end matters as well. Advanced packaging such as CoWoS is scaling fast because AI accelerators need massive memory bandwidth and efficiency. Signals across the chain point to sizable capacity additions into 2026. That supports the view that essential suppliers can expect a full order stream.

The acceleration is not limited to Taiwan. New capacity in the United States is moving faster. That raises the need for a modern fleet of tools across several regions and stretches the investment cycle. When the largest customer raises the bar, rivals and partners usually follow. It points to a broad AI driven upgrade that can run for several years.

Why this funnels to ASML

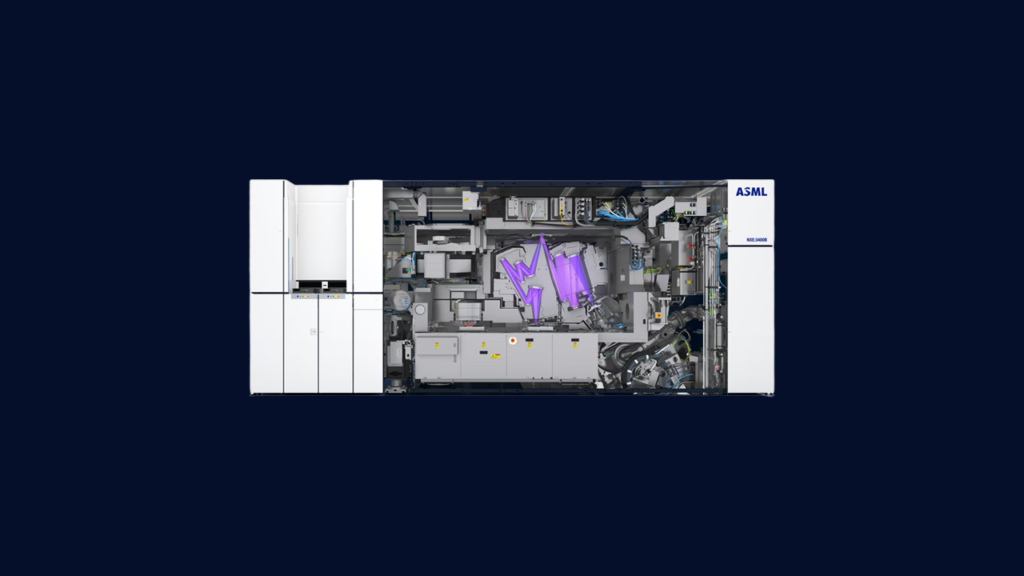

More fab space means more lithography systems. At the front of the pack are EUV and the step to High NA. Industry signals show customers preparing this generation for higher volumes from 2026. That fits a setup where advanced logic and refreshed memory scale together. For ASML this translates into high utilization for the current fleet and a steady flow of new orders at the top of the product stack. It also strengthens the ASML investment cycle at the high end of the portfolio.

The effect reaches beyond simple volume growth. As AI data centers expand, demand shifts not only toward high end EUV but also toward DUV for supporting layers and toward smarter metrology and inspection. Forward views into 2026 and 2027 call for higher spending on chip equipment. That is the kind of extended cycle that suits a capital intensive supplier.

Sentiment helps. The market has clearly flipped the switch to optimism. Upgrades and higher expectations are pushing sector leaders to fresh highs. That is not a promise of straight lines, but it does confirm that investors are reassessing the investment case for the AI building block. For a company that provides the key technology, that creates a solid foundation for demand even when individual end markets wobble.

The thread for traders and investors

The message is straightforward. Strong TSMC revenue is more than a quick headline. It is a signal for the heart of the semiconductor chain. Heat there often leads to concrete investment decisions that take months to prepare. The mix of firm AI demand, a rapid rollout of advanced packaging and preparations for nodes that will hit volume in 2026 and beyond points to a spending climate where strategic suppliers lead. Today delivered another data point in that direction. For anyone watching the sector, that is hard to ignore.

Want to turn headline noise into clear insights you can use. Dive into Bitease to explore the economic calendar, compare brokers and scan the asset index.